Businesses looking to raise money by selling stock may offer one of two different kinds: common stock or preferred stock. Both can be worthwhile investments, and you can find both types of stock on major exchanges.

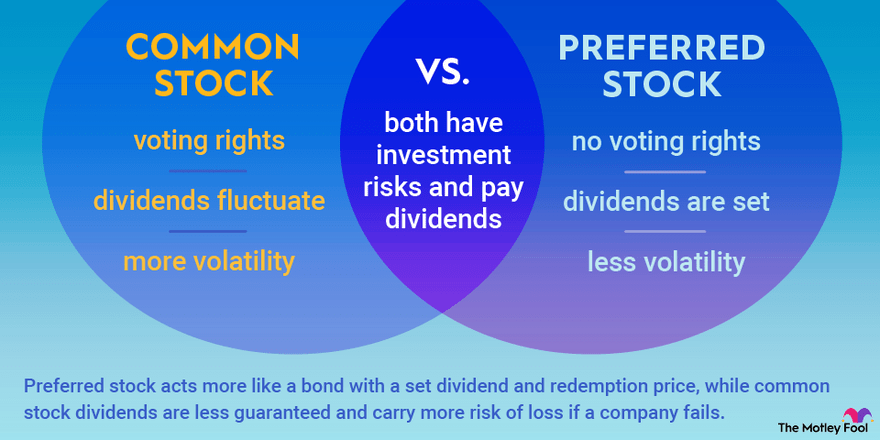

The main difference between preferred stock and common stock is that preferred stock acts more like a bond with a set dividend and redemption price, while common stock dividends are less guaranteed and carry more risk of loss if a company fails. Of course, there's far more potential for stock price appreciation with common stock.

Source: Getty Images

Even though the name might suggest preferred stock is the better investment, the better choice depends on your objective: income now or long-term returns for the future. The table below shows the key differences between common and preferred stock.

| Factor | Common Stock | Preferred Stock |

|---|

| Upside potential | Almost unlimited | Limited to redemption value, except for convertible preferred |

| Downside risk | Can fall to $0 | Can fall to $0 but is less likely to do so |

| Share price volatility | More dramatic movements | Less dramatic movements |

| More suitable for | Long-term growth investors | High-yield dividend investors |

| Number of classes of stock | Usually one but sometimes more if there's a need for special voting rights | Often multiple, with no limit on how many a company can issue |

Common stock

Common stock

Common stock gives investors an ownership stake in a company. Many companies exclusively issue common stock, and there's a lot more common stock selling on stock exchanges than preferred stock.

Investors holding common stock typically have the right to vote on the company's board of directors and to approve major corporate decisions, such as mergers. Some companies have multiple classes of common stock, with different classes having more voting power than others.

The most attractive feature of common stock is that it's an ownership stake in the company. Its value can rise dramatically over time as a company grows bigger, more profitable, and more valuable. This can create enormous returns for investors. For example, here's how much Apple (AAPL 1.66%) stock has gone up since going public:

AAPL data by YCharts.

A $1,000 investment in Apple's IPO would be worth $127,000 at recent prices (as of March 2022); add in the dividends it has paid, and the total return goes to $162,500. There have also been times when Apple shares have fallen sharply over shorter periods. This is part of the risk with common stock, which is far more volatile than preferred stock.

In addition to the risk of losses due to volatility in the short term, common shareholders, as the owners of the company, are last in line to get anything if a company fails. Lenders, suppliers, bond and other debt holders, and preferred stock owners are all ahead of common shareholders because the company has a contractual obligation to pay them first. A common shareholder's willingness to take on the risk of losses if things go badly is offset by the potential for big returns if things go well.

Image source: The Motley Fool

Preferred stock

Preferred stock

Preferred stock often works more like a bond than common stock does. Preferred stock dividend yields are often much higher than dividends on common stock and are fixed at a certain rate, while common dividends can change or even get cut entirely. Preferred stock also has a set redemption price that a company will eventually pay to redeem it. This redemption value, like a bond at maturity, limits how much investors are willing to pay for preferred shares.

The label "preferred" comes from three advantages of preferred stock:

- Preferred stockholders are paid before (get preference over) common stockholders receive dividends.

- Preferred shares have a higher dividend yield than common stockholders or bondholders usually receive (very compelling with low interest rates).

- Preferred shares have a greater claim on being repaid than shares of common stock if a company goes bankrupt.

In other words, they're really "preferred" by investors looking for a more secure dividend and lower risk of losses.

The two main disadvantages with preferred stock are that they usually have no voting rights, and they have limited potential for capital gains. A company may issue more than one class of preferred shares. Each class can have a different dividend payment, a different redemption value, and a different redemption date.

Companies can also issue convertible preferred stock. In addition to the normal attributes of preferred stock, convertible preferred stock gives shareholders the right to convert preferred shares into common stock under certain circ*mstances.

What Are Common Stocks?Most stocks you hear about are common stocks, which represent partial ownership in a company and include voting rights.

What Are Preferred Stocks?A bond that trades like a stock? Preferred stock can have the best (and worst) of both worlds.

Is Common Stock an Asset or a Liability?Assets or liabilities? We explain accounting for common stock.

Undervalued StocksThese stocks can be a great bargain for the right investor.

Most investors buy stocks for long-term growth, so investing in common stock is usually the better choice because of the greater upside potential. The key is to consider your ability and willingness to hold the stock for many years and ride out volatility that can lead to losses if you sell in a downturn.

If your goal is generating income, preferred stock may be the type you're looking for, especially when interest rates are low, resulting in lower yields for the safest bonds. With fixed dividend payouts that are more reliable and usually higher than common stock dividends, they can be very attractive. Just remember that although preferred stock is safer than common shares, it's still not as secure as a bond.

Jason Hall has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple. The Motley Fool has a disclosure policy.

FAQs

Common stock investments have a potentially larger reward, but also come with more risk because they're exposed to the market. Preferred stock investments are a safer investment with fixed-income dividends, but investors may miss out on a share's appreciation they would get with common stock.

What is one advantage of preferred stock over common stock? ›

One advantage of preferred stock over common stock is that preferred stockholders have a higher claim on the company's assets and earnings. This means that if the company faces bankruptcy or liquidation, preferred stockholders are paid off before common stockholders.

Who is preferred stock best for? ›

Overall, preferred shares are an attractive option for investors seeking steadier income with a slightly higher risk profile than bonds but lower risk than common stock. They can be thought of as a hybrid security with characteristics of both debt and equity instruments.

Are preferred stocks good for retirement accounts? ›

So, if you bought for $20, you'll receive a handsome amount of capital gains. There is no better feeling than getting preferred shares at a steep discount and then watching the price recover. You get high yields plus capital appreciation; what a great way to spend retirement.

What is the downside of preferred stock? ›

Among the downsides of preferred shares, unlike common stockholders, preferred stockholders typically have no voting rights. And although preferred stocks offer greater price stability – a bond-like feature – they don't have a claim on residual profits.

Why convert preferred stock to common stock? ›

Convertible preferred shares give their holders the option of converting them into a set amount of common stock shares in the future. This gives the shareholder the potential benefit of capital appreciation in addition to the guaranteed benefit of a regular dividend.

Why might an investor purchase preferred stock instead of common? ›

Preferred stock is also more likely to pay out a higher yield than common shares. Like bonds, preferred stock performs better when interest rates decline. And preferred stock has a par value, that is, a value it's issued at and can typically be redeemed at, when the preferred shares mature.

What are the disadvantages of common stocks? ›

Investors with common stocks own voting rights without any stress of company legalities. However, the profitability of most common stocks is limited because they are prioritized in payouts and the company's freedom to defer dividends until funds are largely available.

Why do investors choose to invest in common stocks? ›

Common stock tends to outperform bonds and preferred shares. It is also the type of stock that provides the biggest potential for long-term gains. If a company does well, the value of a common stock can go up. But keep in mind, if the company does poorly, the stock's value will also go down.

Why not buy preferred stock? ›

Since preferred stock comes with a fixed dividend yield, they are highly sensitive to interest rates. If market-wide interest rates rise above the yield of a preferred stock, it will become harder to sell that stock on the market, and investors would have to accept a steep discount if they wish to sell.

These seven low-risk but potentially high-return investment options can get the job done:

- Money market funds.

- Dividend stocks.

- Bank certificates of deposit.

- Annuities.

- Bond funds.

- High-yield savings accounts.

- 60/40 mix of stocks and bonds.

While preferred stock is senior to common equity on a bank's balance sheet, it falls below all other creditors, including subordinated or senior unsecured debt. The risk is that in a bank liquidation, preferred shareholders would get little to nothing in recovery. This is known as subordination risk.

Do preferred stocks do well in a recession? ›

Preferred dividends take priority over common share dividends. In a company break-up, preferred shares get priority treatment, after bonds. Thus, investors see, rightly so, that preferred shares are “safer” in times of economic trouble.

What does 7% preferred stock mean? ›

What Is an Example of a Preferred Stock? Consider a company is issuing a 7% preferred stock at a $1,000 par value. In turn, the investor would receive a $70 annual dividend, or $17.50 quarterly. Typically, this preferred stock will trade around its par value, behaving more similarly to a bond.

Should I keep my preferred stocks? ›

The Bottom Line. There are a number of strong companies in stable industries that issue preferred stocks that pay dividends above investment-grade bonds. So, if you're seeking relatively safe returns, you shouldn't overlook the preferred stock market.

Is common stock or preferred stock riskier? ›

Because common stock is more volatile, it is considered a higher risk investment than preferred stock. But common stock also has the potential to accumulate capital appreciation in the long run, which can significantly increase the investment value.

Why would a company issue preferred shares instead of common shares? ›

Issuing preferred stock provides a company with a means of obtaining capital without increasing the company's overall level of outstanding debt. This helps keep the company's debt-to-equity (D/E) ratio, an important leverage measure for investors and analysts, at a lower, more attractive level.

What are the benefits of common stock? ›

Common stocks, when compared to bonds and deposit certificates, perform better. However, there is no upper limit on the investor's earnings from their common stock holdings. Therefore, common stocks are less expensive and more practical alternatives against debt investment.

Why are common stocks considered a risky direct investment? ›

Investing in common stocks is never risk free. If the company that issued the stock goes bankrupt, you could lose your investment. Companies that go bankrupt will only make payments to common stockholders after creditors and preferred stockholders have been paid.