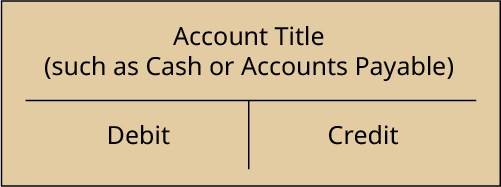

Each account can be represented visually by splitting the account into left and right sides as shown. This graphic representation of a general ledger account is known as aT-account. A T-account is called a “T-account” because it looks like a “T,” as you can see with the T-account shown here.

Adebitrecords financial information on the left side of each account. Acreditrecords financial information on the right side of an account. One side of each account will increase and the other side will decrease. Theending account balanceis found by calculating the difference between debits and credits for each account. You will often see the termsdebitandcreditrepresented in shorthand, written asDRordrandCRorcr, respectively. Depending on the account type, the sides that increase and decrease may vary.

We can illustrate each account type and its corresponding debit and credit effects in the form of anexpanded accounting equation.

As we can see from this expanded accounting equation, Assets accounts increase on the debit side and decrease on the credit side. This is also true of Dividends and Expenses accounts. Liabilities increase on the credit side and decrease on the debit side. This is also true of Common Stock and Revenues accounts. This becomes easier to understand as you become familiar with thenormal balanceof an account.

Normal Balance of an Account

Thenormal balance is the expected balance each account type maintains, which is the side that increases. As assets and expenses increase on the debit side, their normal balance is a debit. Dividends paid to shareholders also have a normal balance that is a debit entry. Since liabilities, equity (such as common stock), and revenues increase with a credit, their “normal” balance is a credit. Table 1.1 shows the normal balances and increases for each account type.

| Type of account | Increases with | Normal balance |

|---|---|---|

| Asset | Debit | Debit |

| Liability | Credit | Credit |

| Common Stock | Credit | Credit |

| Dividends | Debit | Debit |

| Revenue | Credit | Credit |

| Expense | Debit | Debit |

When an account produces a balance that is contrary to what the expected normal balance of that account is, this account has anabnormal balance. Let’s consider the following example to better understand abnormal balances.

Let’s say there were a credit of $4,000 and a debit of $6,000 in the Accounts Payable account. Since Accounts Payable increases on the credit side, one would expect a normal balance on the credit side. However, the difference between the two figures in this case would be a debit balance of $2,000, which is an abnormal balance. This situation could possibly occur with an overpayment to a supplier or an error in recording.

Long Descriptions

A representation of a T-account. There is a horizontal line across the center, above which is the label Account Title (such as Cash or Accounts Payable). There is a short vertical line extending below the center of the horizontal line. The space to the left of the vertical line is labeled Debit. The space to the right of the vertical line is labeled Credit. Return

A representation of the expanded accounting equation divided into an upper and lower section. The upper section reads, from left to right, Assets equal Liabilities plus Equity. Equity is above a long horizontal line below which is labeled, from left to right, Common Stock minus Dividends plus Revenues minus Expenses. The lower section contains six T-accounts that are arranged under the labels in the upper section. The top of each T-account is labeled Debit on the left side and Credit on the right side. The T-account below Assets is labeled Increase on the left and Decrease on the right. The T-account below Liabilities is labeled Decrease on the left and Increase on the right. The T-account below Common Stock is labeled Decrease on the left and Increase on the right. The T-account below Dividends is labeled Increase on the left and Decrease on the right. The T-account below Revenues is labeled Decrease on the left and Increase on the right. The T-account below Expenses is labeled Increase on the left and Decrease on the right. Return